目录

ToggleInvestment Opportunities in the GB200-PCB Sector..

FAQ

What are the core updates to the architecture of the GB200-PCB sector?

The architecture of the GB200-PCB sector has brought about some significant updates that have a notable impact on the overall value of the PCB industry.

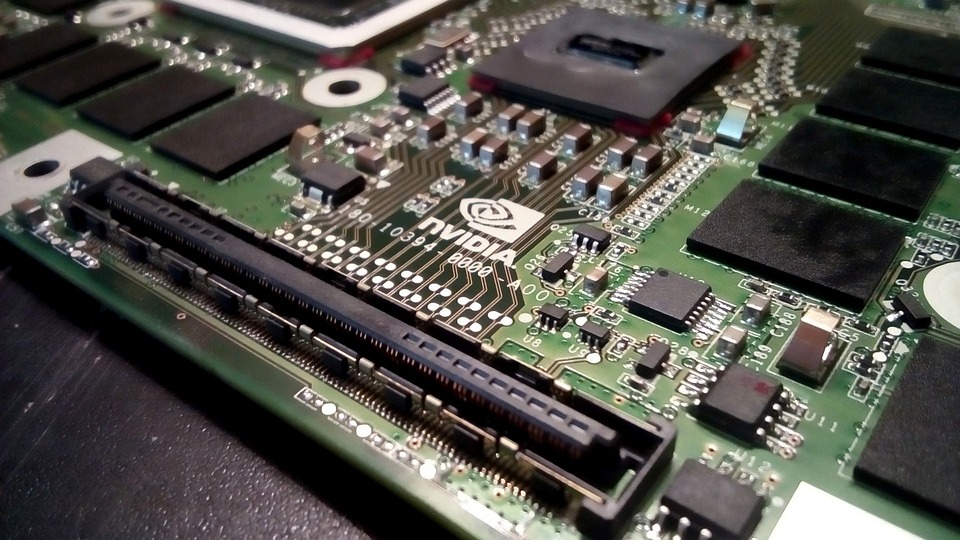

Firstly, it is expected that the usage of PCBs in the GB200 structure will increase significantly. In a rack configuration containing 72 GPUs, each rack consists of multiple foundational components, with the computertree structure being a core part. Each tree contains two PCB units, with each unit housing two GPUs and one CPU.

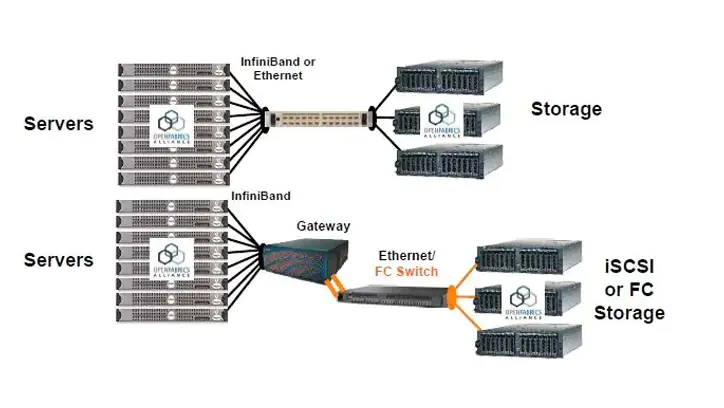

Furthermore, NVIDIA switchtree serves as an intermediary for information exchange between GPUs, and InfiniBand (IB) switches are utilized for network connections, both of which are crucial areas of PCB application.

Will copper wiring replace PCBs, and what is the relationship between the value and quantity of the two?

While there are discussions among experts in the market about the possibility of copper wiring replacing PCBs, we believe that such a viewpoint oversimplifies the matter. In the architecture of GB200, although copper wiring is introduced, ASIC chips still require the use of PCBs because the line width and spacing of copper wiring cannot meet PCB standards. As the integration level of electronic products increases, the role of PCBs remains indispensable. Additionally, from an economic perspective, the value and quantity of PCBs are expected to increase significantly, especially with the bandwidth increase of switch ASICs.

How is the value and quantity of PCBs calculated in the GB200 architecture?

In the GB200 architecture, we determine the corresponding PCB specifications and value by analyzing the bandwidth on each board.

For example, the bandwidth on PCBs carrying GPUs and CPUs is approximately 900GB per second, requiring the use of high-density interconnect (HDI) technology. Meanwhile, the bandwidth on switch PCBs is around 57.6TB, which indicates that each rack contains two IB switches.

The primary PCB composition of one rack includes 36 PCB units, each with a bandwidth of 0.9TB, priced at approximately 20,000 RMB per square meter, resulting in a value of 72,000 RMB. The unit price of NVLink switch PCBs is around 60,000 RMB per square meter, resulting in a value exceeding 100,000 RMB. The total value of every two IB switches is 18,000 RMB.

What impact does the promotion of the GB200 architecture have on PCB manufacturers?

The promotion of the GB200 architecture will have a positive impact on PCB manufacturers. With the enhancement of GPU interconnectivity in the GB200 architecture leading to an increase in the number of switch ASICs, it drives up the value and quantity of PCBs. The value of a single GPU-associated PCB is approximately 0.3 million RMB, representing a 150% increase compared to the HH100 superpod. This indicates that mainstream PCB manufacturers can anticipate promising prospects in the future and will benefit from the promotion of the GB200 architecture and the corresponding improvement in product specifications.

How does the value and quantity of PCBs change in larger-scale clusters?

In larger-scale clusters, such as configurations connecting eight racks, the overall value of PCBs can exceed 3 million RMB, with the value of each PCB associated with a GPU being approximately 53,000 RMB. This represents nearly a 300% increase compared to the configuration of a single rack, primarily benefiting from the addition of L2 layers and a greater number of levels in the IB switch network. This change indicates that as the cluster scale expands, the value of PCBs also increases.

What are the main factors influencing the increase in the value of PCBs in the GB200 architecture?

The increase in the value of PCBs in the GB200 architecture is primarily influenced by the increase in bandwidth of switch ASICs. As bandwidth increases, the performance requirements for PCBs also rise, thereby driving up their value. Additionally, the enhancement of GPU interconnectivity in the GB200 architecture leads to an increase in the number of switch ASICs, which is another important factor contributing to the increase in the value of PCBs.

What is the basis for the market claim that copper wires may replace PCBs?

The claim in the market about copper wiring potentially replacing PCBs is primarily based on the usage of copper wiring in certain applications. However, this perspective overlooks the irreplaceability of PCBs in high-performance computing and high-speed data transmission, among other aspects. Rack-mounted servers have never universally adopted PCB backplanes, and NVIDIA’s GB200 architecture has already begun using copper wiring, but this does not imply that PCBs will be entirely replaced. As the integration level of electronic products increases, the importance of PCBs will be further highlighted.

Has there been any change in the power supply requirements of the GB200 architecture?

Regarding the power supply issue of the GB200 architecture, there are currently no clear indications suggesting significant changes in its power supply requirements compared to before. Power supply design typically adjusts according to hardware power consumption and performance needs. While the GB200 architecture’s enhancements in GPU quantity and performance might potentially impose higher demands on the power supply system, the specific power supply requirements still need to be determined based on actual product specifications and design.

Can copper interconnects bring increased profits to Luxshare Precision?

Copper interconnects have indeed brought some new incremental opportunities to the PCB industry. However, for Luxshare Precision, it is currently uncertain whether domestic manufacturers have joined the supply chain for copper interconnects. Therefore, it is not possible to provide an official and reliable conclusion on whether Luxshare Precision can increase profits through copper interconnects at this time.

What are the PCB suppliers for GB100 and GB200?

The PCB suppliers for GB100 primarily continue to utilize the supply chain from the previous H100. For GB200, the PCB suppliers are not entirely confirmed at the moment, but mainstream manufacturers, especially switch suppliers like Huadong Electronics, are expected to have significant incremental opportunities.

Why is there an increase in PCB usage in the GB200 architecture?

The increase in PCB usage in the GB200 architecture is primarily related to NVLink and NVSwitch. Although the number of GPUs per unit has increased from one GPU per unit in the past to two GPUs per unit now, the overall increase in value is not as significant as expected. Specification-wise, the PCB has reached a six-order HDI level, and while the bandwidth has decreased, the improvement in specifications has indeed increased the overall value.

What is the configuration relationship between the GB200NVL72rack and the cabinet?

In a cabinet, there are 18 nodes, and assuming a full complement of 72 GPUs, one NVLink switch will utilize nine ASIC chips, each with a total bandwidth of 57.6T. Here, we primarily discuss the configuration of the downstream link. As for the upstream link, two ID live switches need to be configured in one rack. This constitutes the basic configuration relationship between the GB200NVL72rack and the cabinet.

Will internal interconnection within the cabinet reduce the usage of external switches, and how does it affect the overall rack quality?

When discussing the GB200 architecture, we need to clarify the relationship of network architecture. The internal interconnection within the cabinet, utilizing NVLink switches, is not the same as conventional switches. Rather, they serve as specialized exchange boards for downstream interconnections between GPUs. Given that they need to connect 72 GPUs, the number and bandwidth requirements of these interconnect links are exceptionally high. This necessitates the use of ASICs with higher bandwidth for connectivity, and correspondingly, the PCB serving as a carrier also needs to enhance its quality and performance.

On the other hand, the architecture of external switches remains the same as that of the H100 superpod’s external IB network architecture. With the increase in total bandwidth, the bandwidth of external IB network switches also increases correspondingly, thereby enhancing the overall dynamic performance. Consequently, the overall rack quality is improved to meet higher performance requirements.

How is the value of PCB calculated in the GB200 architecture?

In the GB200 architecture, the total PCB usage in the entire cabinet can be divided into four main components: computenode, NVLink switch, IB leaf switch, and IB spine switch. The combined PCB usage of these four components is approximately 216,000 RMB in value, with the computenode component accounting for around 70,000 RMB, the NVLink switch component around 100,000 RMB, and the two IB switch components totaling approximately 36,000 RMB.

If eight racks are connected together, the overall PCB usage will exceed 3 million RMB due to the addition of L2 layer connections and increased spy network bandwidth. Calculated per GPU, this equates to a PCB usage level of approximately 5,530 RMB.

What are the differences in PCB usage between GB200 and GH200, as well as between B100 and H100?

When comparing the PCB usage between GB200 and GH200, as well as between B100 and H100, it’s important to note that the comparison between B100 and H100 is primarily related to the increase in bandwidth and the use of network interfaces C×8 or C×7, so the increase in PCB usage is not significant. However, the PCB usage in GB200 has significantly increased, as the number of connections has increased several times, despite only doubling the GPU bandwidth.

What is the expected market penetration rate of GB200?

The market penetration rate of GB200 is closely watched as it is expected to be high. If the penetration rate reaches 50%, the value of PCBs in the entire AI server market could potentially double. This indicates the significant market potential of the GB200 architecture and its profound impact on the PCB industry.

What are the predictions for the number of GPUs and racks in GB200?

The current predictions for GPUs may exceed one million units, suggesting there could be tens of thousands of corresponding racks. As for the expectations regarding the quantity and distribution of GB200, it appears that there are approximately one million units of GB200, two million units of B100, and some H-series products. The expected number for next year’s B100 and B200 series is two million units.

What is the estimated number of cabinets for GB200?

If we calculate based on over 1 million CPUs, with each cabinet configured with 18 GB200 units, the estimated number of cabinets that can be shipped would be around 55,000. This is just a preliminary estimate, and there are indications that this number could be revised upward. This indicates that the promotion of the GB200 architecture will bring a significant demand for the PCB industry, positively impacting its development.

According to calculations, the estimated PCB production for next year is only slightly over three million units. Is this quantity considered low?

While this number may appear conservative, it’s important to consider that PCBs are primarily used for inference tasks, and the demand for inference may increase rapidly. There isn’t a precise figure yet to predict how much the quantity could grow, but the market potential for PCBs used in inference tasks is significant and shouldn’t be overlooked.

If PCBs are only used for training, is slightly over three million units sufficient?

Indeed, if PCBs are solely used for training tasks, slightly over three million units may already be sufficient. However, since some PCBs used for training tasks are also employed in inference tasks, this could lead to an increased demand for PCBs in the market, thus becoming a factor for upward revision in expectations. With the advancement of AI technology and the expansion of application domains, the demand for PCBs in inference tasks is also continuously rising.

What is the difference in value between PCBs used for inference and those used for training?

There is a significant difference in value between PCBs used for inference and those used for training. PCBs of the same specifications may have a large disparity in price. For example, if we estimate the price of an H-series PCB at $70, an L40 PCB may only cost between $10 to $20. On the surface, the price of inference PCBs may not seem high. However, the key point is that as more and more training PCBs are repurposed for inference tasks, the value of inference PCBs is gradually increasing. This is a major factor in the current AI hardware market transition and a key driver for the growing demand for inference PCBs in the market.

What are the market prospects for inference PCBs?

The market prospects for inference PCBs are very promising. With the continuous advancement of artificial intelligence technology and the expanding application domains, inference tasks are becoming increasingly important across various industries. From autonomous driving to smart homes, from medical diagnostics to financial services, inference PCBs play a crucial role in supporting these intelligent applications. Therefore, the demand for inference PCBs is expected to continue growing as AI technology becomes more widespread.

What are the driving forces behind the growth of the GB200 PCB sector?

The growth of the GB200 PCB sector is primarily driven by several factors.

Firstly, the rapid advancement of AI technology, particularly in the fields of deep learning and machine learning, has led to an increasing demand for high-performance computing hardware.

Secondly, as AI applications penetrate various industries, the demand for PCBs in inference tasks is also continuously rising. Additionally, as the market penetration rate of GB200 products increases, it is expected to bring about more demand for PCBs.

Finally, since PCBs used for training tasks are also utilized in inference tasks, this will further drive the growth of the GB200 PCB sector.